Payroll and the Bottom Line

Whether you’re a sole trader responsible for payroll or you’re managing a small, medium or large business, making sure you’re up-to date with all the latest pay rates and regulations is critical.

All workers in the UK of school-leaving age and over are entitled to minimum rates of pay, and these rates are dependent on their age and whether or not they’re an apprentice. The rates are a legal requirement, and failing to meet them could result in the employer being fined.

The rates change every April, so it’s essential that you update your payroll each year to reflect these changes. From a business planning perspective, it’s also a good idea to keep your eye on the rates announced in the Budget so you can plan your payroll for the following financial year.

National Minimum or Living Wage?

National Minimum or Living Wage?

For business owners new to taking on staff, one of the common questions is, “What is the difference between the National Minimum Wage and the National Living Wage?”

The answer is surprisingly simple.

HMRC states a worker must be at least:

- school leaving age to get the National Minimum Wage

- aged 25 to get the National Living Wage – the minimum wage will still apply for workers aged 24 and under

It is, however, slightly more complex if you are employing apprentices.

Apprentices are entitled to the apprentice rate if they’re either:

- aged under 19

- aged 19 or over and in the first year of their apprenticeship

However, apprentices are entitled to the minimum wage for their age if they are both:

- aged 19 or over AND

- have completed the first year of their apprenticeship

So what are the Minimum Rates of Pay?

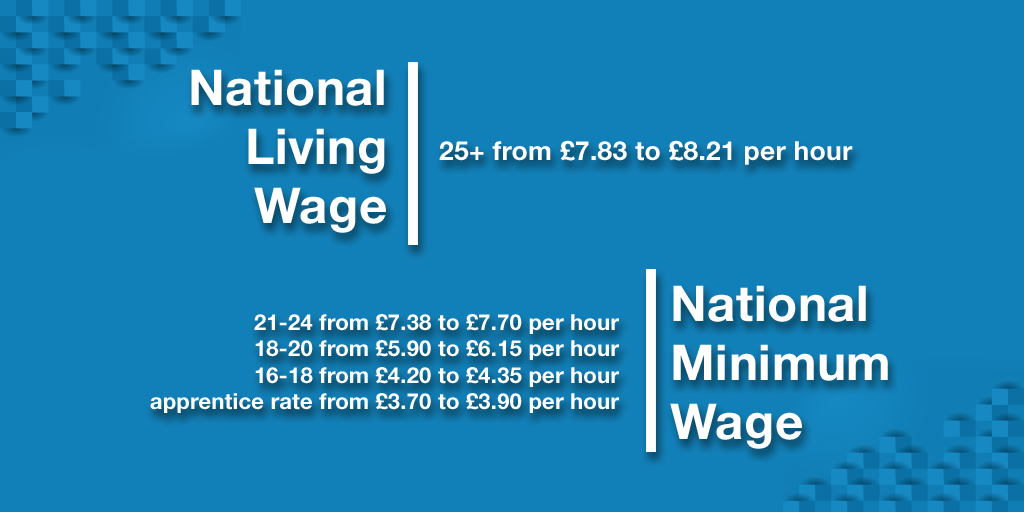

The latest rates of pay for the National Minimum Wage and National Living Wage came into effect on 1st April 2019.

Here’s a handy rate reference table showing the rates for 2019/20 and how they compare to last year:

Considerations with Payroll

As well as ensuring your business is paying your staff at the right rates, there are also a number of other areas to consider when working out salaries.

National Insurance

If your staff are earning more than the allowable levels, you will need to pay Employers National Insurance, as well as deducting the appropriate employee contributions from their take-home pay. Employers also pay Class 1A and 1B National Insurance once a year on expenses and benefits they give to their employees. The rate for the tax year 2019/20 is 13.8%.

Auto-enrolment

Staff pensions are also a consideration. Automatic enrolment into a pension scheme was phased in from 2012 and applies to all businesses employing staff. If your staff are earning enough to hit the auto-enrolment threshold and meet the criteria, you will need to enrol them into an employer’s pension scheme. The minimum total contributions under automatic enrolment have been set down by the Government. Currently the employer’s contribution is 3%.

Making Tax Digital

The government introduced a new way to file and pay tax in April 2019. This currently only applies to VAT-registered businesses with a taxable turnover above the VAT threshold. These businesses are now required to use the Making Tax Digital service to keep records digitally and use software to submit their VAT Returns.

However, the system will be slowly rolled out to all businesses, large and small. Making Tax Digital will mean that you will need to keep digital records and use specific software to submit your records to HMRC.

Need Advice or Help with Payroll or Making Tax Digital?

If you’re new to payroll, have just taken on more staff or are not sure where to start with Making Tax Digital, Smith Newmans can help!

Get in touch with our experienced team on 023 8060 2100 or send us an email at www.smith-newmans.com/contact-us.